In the matter of finances, technology nowadays plays a significant role in making it more user friendly. There is a lot of different ways in and reasons for which online economics is necessary. And this is possible with the help of technological applications that are easy-to-use and reliable. Owing to the availability of mobile apps for almost all there’s a growing demand for automation. Moving into the mall is no longer necessary for the bank or library. We have software for stuff like that.

But fintech apps still lag behind in features compared with banking, education, healthcare, and other categories apps. Usually, they are restricted to the management of bank accounts, online purchases, transactions, or budget-making. But there is so much more to it than a little imagination to be achieved. This is a gaping, business void.

App development companies like topflightapps make the development process easier for startup founders as they have a high number of articles on how to build different apps, and they can use them as per their convenience. So let’s take a short look at fintech apps types.

1. Banking

Source: borgenproject.org

First and foremost, Fintech works well to make the banking process easier for users by creating it online-friendly. The mobile version software allows functions such as checking account history, making transactions, searching for nearby ATMs, and much more. Additionally, one can pay bills too while using these apps.

The technology used to make this possible are advanced, including AI technology, Voice and Face biometrics, and even chatboxes. Some of the features that these apps contain are a useful notification system, remittances for international transfers, anti-money laundering characteristics, and report management.

2. Investment

Source: thebalance.com

Investment is another aspect of finances that is made more comfortable with the help of Fintech software. One needing to invest in a company or individual can safely use such apps to monitor their investment history. Such apps are present in both PC and mobile formats, and the investment management data and analytics ensure effective operation.

Moreover, users can manage, execute, and trade orders from one platform and get regular transaction reports. This helps employees to accurately assess the client’s investment-related behavior and use market data information to get better strategies.

3. Personal Finance

Source: bbva.com

One of the most important aspects of online Fintech software is for regular people to go about with their ordinary financial management. Thus, to improve their ability to monitor their income and spending, personal finance apps are useful. With the help of these, one can see detailed information about their transactions, receive reminders, send money easily, etc. Not to mention, this software also supports other currencies for international transactions, following the valid rate of currency exchange.

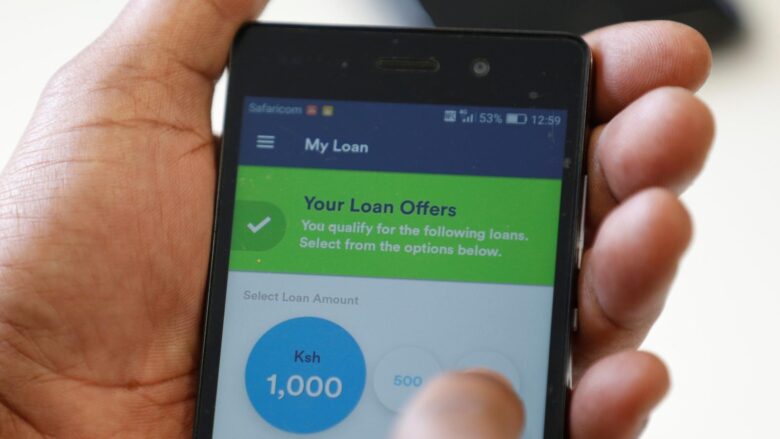

4. Lending

Source: qz.com

One can lend someone money using such apps too, and many companies adopt it well. These applications’ function includes understanding and verifying the users’ credit situation and improving the connection between lenders, partners, and borrowers. Indeed, some of its most progressive features include managing the input forms, securing user authorization and system authentication, establishing collateral module, etc, features that you can include in your own app using Financial Services at VentureDive as well, an esteemed fintech software development company.

Now that we are aware of the anticipated increase in demand for mobile lending services, let’s see what value they provide on both ends.

FOR CUSTOMERS

Loan Applications are eligible for a variety of reasons. By eliminating the need for face-to-face contact with financial organizations, they make life simpler for consumers. Here’s how borrowers profit from applying for a loan:

- Apply for a loan from basically anywhere without visiting an office

- Get money into a bank account within one day

- Be assured your personal details will be secured

- Check for the best deals

- A loan from the same app is repaid easily

- Lender and borrower in the Loan App

FOR LENDERS

The benefit of making their services accessible online and on mobile is also provided to lenders. Since there is no face-to-face contact with borrowers, lenders will reduce their operating costs and concentrate on more loans being handled.

- Reduces running expenses

- Fasten KYC procedures

- At the same time, attract more customers

- Moving into underserved markets

- Boost product lending by using AI

As we can see, as the lending process takes it to the cloud or mobile devices, both borrowers and lenders get plenty of benefits.

5. Payments

Source: medium.com

Digital payments are the next big thing that Fintech Software allows for in mobile wallets. Using this, one does not have to continually go to a physical bank, and they can purchase items through the phone. To make it more secure, factors like blockchains, fingerprint sensors, and webcams are incorporated. This improves usability, precision, time-limit, and fraud protection. For companies, features like systematic analytics, international payments, and dispute resolution are highly beneficial.

6. Insurance

Source: businessinsider.com

Similarly, another aspect of financial management that these apps focus on is insurance. To elaborate, insurance companies use technologies like data science, mobility software, etc., to make the process easier for clients. The information is usually gathered and processed with the help of connected devices, sensors, and wearables. This allows them to understand the risks and client situation in real-time, and create personalized recommendations, offers, and dynamic pricing.

Of course, there are certain steps involved in how to create such apps. They are mentioned hereafter.

- A platform- Firstly, you should understand what purpose your app should serve, and their prospective audience. Whether you want to focus on the borrowers, the lenders, etc., is vital to consider.

- Features- Based on the type of platform you decide on, you can include the particular features.

- App-construction blocks- There are existing building blocks for apps present in APIs, code libraries, SDKs, etc. Review them and see what works best for you.

- Focus on UI and UX- Use high-fidelity mockups to make a clickable prototype for users.

- Make MVP- After the verification of the previous prototype is complete, employ experienced app developers to create and fine-tune an MVP version.

- User Feedback- Using the built-in analytics, understand and decode users’ feedback and make necessary changes.

- App maintenance- It is essential to keep on updating the apps with the freshest OS technology for better user experience.

Overall, there are many merits of Fintech apps for the public, and making an effective one is critical for user satisfaction.