The Internet of Things dominates your life, even if you haven’t heard the phrase before.

The Internet of Things (IoT) describes the collection of apps and devices that communicate over the Internet. It powers the inconspicuous fitness tracker around your wrist that sends personalized activity reports viewable via an app from your phone. Likewise, you can thank the IoT for your integrated smart home that lets you talk to the person at your door, even if you aren’t home to answer it in person.

In an increasingly connected world, the IoT has made it possible to have this immediate oversight and control over your finances. All you need is a mobile phone or computer to tap into this network of financial apps, services, and networks.

The Internet of Things, a Definition:

Source: strate.education

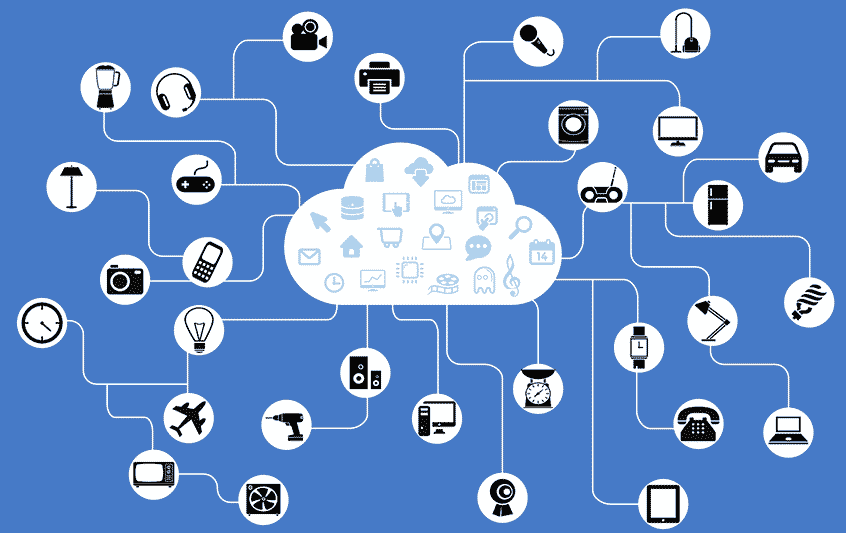

Before jumping into how the IoT has changed the way you manage your finances, let’s get into the nitty-gritty of what the IoT stands for. The Internet of Things defines the web of apps, devices, and systems that can communicate with one another over the Internet.

First coined in 1999 by computer scientist Kevin Ashton, IoT first described a relatively primitive version of the web of interconnectedness we know today.

Ashton conjured up the term when developing an inventory system that relied on Radio Frequency Identification (RFID) technologies to track products as they moved through the supply chain. These RFID chips would send real-time information to the manufacturer about where an item was at any given time.

Today, the IoT has expanded to include a plethora of “smart” technology that exchanges data freely with other devices or networks wirelessly — like a thermometer you can adjust using a smartphone connected to the Internet.

This example is just one of many items that belong to the IoT. The IoT’s extensive web includes everything from everyday objects like computers, wearables, and home appliances to industrial machinery and infrastructure.

FinTech Belongs to the Internet of Things

Source: datasciencecentral.com

FinTech (a cutesy portmanteau of financial technology) describes innovative technology that supports modern financial services.

Admittedly, this broad definition is an umbrella term with enough wiggle room to describe a multitude of processes occurring in the financial system, including automatic calculations the Big Banks use to complete enormous transactions.

Today, however, most people refer to FinTech when talking about the partial or fully automated services that put consumers in control of their finances. Often in contrast to traditional in-person banking, FinTech represents digital services you can access from your phone, computer, or even smartwatch.

Take, for example, the online lender and loan services provider MoneyKey. Its digital platform hosts and processes online applications, automating the qualification process to speed up the borrowing experience. It relies on FinTech services to deliver direct deposit loans and receive digital payments.

Another example of FinTech is the money management app Mint. It aggregates your many financial accounts in one interface so that it can track your spending in real-time and alert you to upcoming due dates.

Thanks to the IoT, services like MoneyKey and Mint have flourished, and the FinTech ecosystem has grown to include countless companies and apps. Estimates placed the global FinTech market at 133.84 billion USD in 2022, with expectations that it will rise to a soaring 556.58 billion USD by 2030.

How the IoT Has Changed Personal Finances

Source: toppandigital.com

By making FinTech apps and online services possible, the IoT has reshaped the way you manage your money. Here’s how:

1. On-Demand Information

Gone are the days you have to visit a bank branch to check your account balance. Today, you can sign into your checking account from anywhere you get Internet and have immediate access to this account, ready to transfer funds, pay bills, or open a savings account.

Once you’re done there, you can instantly switch from your checking account to a line of credit profile and investment account without moving much more than your fingers.

2. Connected Banking

Source: bankhawk.com

Have you ever received an email authorizing a purchase on your VISA card? Or maybe a text notification that informs you a friend accepted your money transfer? What about an alert from an identity theft protection service?

These integrated communications are only available thanks to the IoT that connects your digital accounts to your phone, tablet, or computer.

But this connection goes beyond just how a FinTech company can communicate with customers. The IoT also streamlines your banking experience with the help of aggregates. Integrated technology makes it possible for financial services to collect data from your financial footprint, then aggregate and visualize it all on one platform.

Aggregation, where possible, cuts down on the number of accounts you have to individually check on your own. Instead, you can authorize a company to access your data and seed your financial accounts via a single app or desktop service.

3. Mobile Wallets

You can thank the IoT for your Apple Pay or Google Wallet. This technology has facilitated the development of smart payment systems, making transactions seamless, secure, and mobile.

Near Field Communication (NFC) technology gives mobile phones and wearables the ability to “talk” to payment terminals. With just a hover or tap, you can exchange account information necessary for the transaction saved on your mobile wallet. NFC joins Ashton’s RFID chips (that are now embedded in most debit and credit cards) to enable contactless payments.

4. Online Security

With the growing concern about cybersecurity, IoT-enabled technology can adopt enhanced security measures to protect financial information. Engineers can integrate biometric authentication, facial recognition, and multi-factor authentication systems into IoT devices and applications, ensuring secure access to financial accounts.

5. Automation and Speed

Source: nojitter.com

One of the key drivers behind the rise of FinTech services is the desire to enhance customer experiences and deliver services in real time. Borrowers especially want fast, convenient, and automated solutions from online services, and the IoT delivers them.

The Bottom Line

The Internet of Things has transformed the way you manage your money, giving you instant and secure ways to connect with your financial accounts. Time will only tell what the future has in store for FinTech, the IoT, and — more importantly — your finances.